With a some simple research and a quick phone call, scam artists are taking advantage of the elderly in the worst possible way: by tugging on their heartstrings and pretending to be their grandchildren.

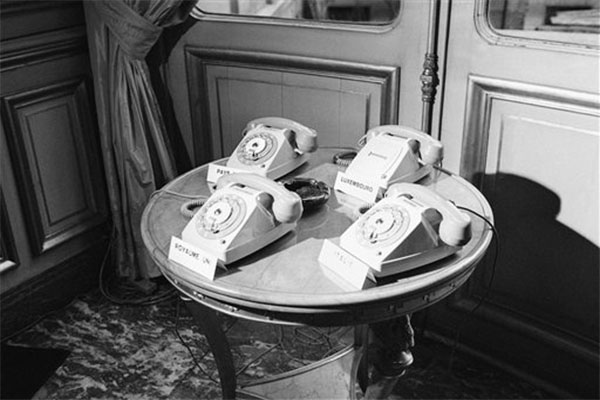

It’s called “The Grandparent Scam.” The National Council on Aging (NCOA) listed it as number 10 on its list of “Top 10 Financial Scams Targeting Seniors.” According to AARP, many different versions of the scam exist, but it always starts with a phone call. The person on the line says he or she is your grandchild and then pleads for help. Some of the scam artists will say they are in trouble with the police. Some will say they need help with medical bills. They will always ask for money.

Many of the police precincts in Brooklyn said that they receive phone calls regarding this particular scam. They also note that it is not the only kind of scam out there; there are many others. A typical one: A scam artist claims to be from the IRS. Wiletha Jones, an officer from the 68th Precinct, who hears many of the complaints regarding this scam, said that the IRS types of scams increase as the tax season starts to come to a close. She also noted that the elderly are not the only ones targeted by this kind of scam artist. Such crooks also target newcomers to the U.S. She said the reason for this is because the scam artists know new immigrants may not know the laws very well, and “official calls” from the IRS can scare them into unknowingly giving away their money. “Nobody from the IRS really calls you,” Jones said, adding that the organization is more likely to send a letter.

Although different scams employ different kinds of phone calls, the agenda is the same: money. Unfortunately, since the people making the calls usually use pre-paid disposable cell phones, the police are usually unable to catch the culprits. The Brooklyn Police that The Brooklyn Ink interviewed were all in agreement that the best way to avoid the scam is to not acknowledge the phone calls.

But is it really that easy to avoid the calls? Christine Sneed, an author from the Chicago area, wrote a column for The New York Times in April of 2015 about when her grandfather fell victim to the scam. She said that around three and half years ago her grandfather received a phone call from a scam artist pretending to be Sneed. The fake granddaughter claimed to have been arrested in Spain. Like so many of such callers, the girl asked Sneed’s grandfather not to tell her parents. Sneed said that her grandfather sent around $6,000 via wire transfer over a period of a couple of days.

Sneed found out about the scam a week later when her grandfather called to ask when she had gotten home from Spain. She said that the worst part about the scam was dealing with the aftermath. Sneed said that her grandfather had difficulty speaking with her after the scam occurred. Sneed thinks that this was because he was upset to discover the caller wasn’t really his granddaughter. It was as if he was being deceived by his own senses. “[It was] hard for him,” Sneed said, “He really thought it was me.” She added that what is worse than losing the money for elderly people who have been scammed is that it causes their self confidence to be “really badly undermined.” They begin to feel like they’re losing control of their lives. Sneed said that she finally has begun to be able to speak with her grandfather again, but it has taken more than three years of work to regain their relationship.

Many people, like Sneed’s grandfather, never get their money back. “It’s like throwing a bundle of cash out the window,” she said. In order to help protect further victims of this scam, the AARP has created a list of things people can do. The first thing the organization recommends is to be skeptical of any phone calls of this nature. The FBI also says to resist the temptation to act quickly. It also added that people should ask very specific questions to the caller, things that only the person they say they are can answer.

Unfortunately, according to the AARP, there is nothing that can be done once money has been wired. If the transaction has just occurred, call the wire transfer service and have the transaction canceled. If it is too late for that, the best that can be done is to file a complaint with local police departments as well as the Federal Trade Commission.

UPDATE 12.28.15: Whitepages, a company that has developed an app that can be used to detect scam phone calls, released a report called “State of the Unwanted Call.” The report says that spam and scam phone calls increased by 55 percent in 2015. They detected 67 million fraudulent calls and said that as much as 26 percent of that was spam callers asking for money. In their list of top five fraudulent calls, the extortion call, a false story about a friend or loved one for financial gain, was third. Two area codes from New York (646 and 347) were also on the company’s top 10 list of area codes were scam calls originated.

Leave a Reply