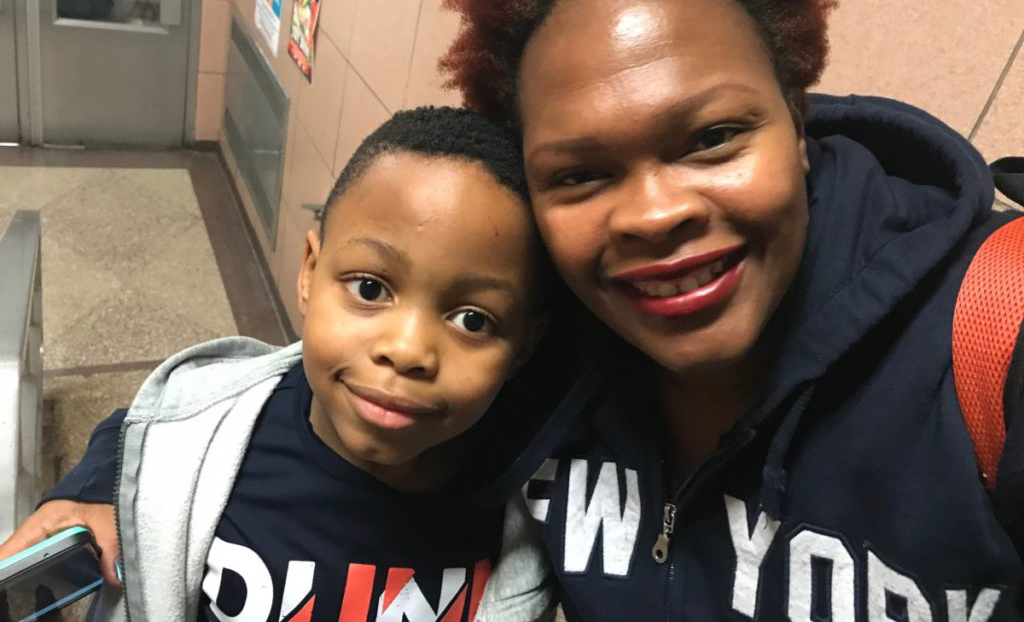

Loyiso Mkele, a 37-year-old South African immigrant, walks through the green hollow metal doors of Public School 11/Purvis J Behan, in Clinton Hill, Brooklyn, with her six-year-old son Undi. Down a short flight of stairs, past another set of doors and into the hallway, Mkele writes down her name and address. She is handed a plastic bag full of fliers and brochures and walks into the Viola Q. Abbot auditorium of the school.

About 100 people from all over the city are seated in the dimly lit room, and they all listen with rapt attention to the woman speaking at the front of the stage. With a projector screen behind her, Latoya Campbell, an Affordable Housing Marketing Manager for the group Impacct Brooklyn explains the concept of “Area Median Income” to the audience. “You’re looking at what your household income can afford, not the rent you can afford,” Campbell says, as people rustle through their plastic bags of leaflets and printouts, looking for the housing information Campbell has just referred to.

The city is making an aggressive effort to provide 300,000 affordable housing units for families by 2026 in a new, accelerated development plan announced by Mayor Bill de Blasio shortly after his re-election this month. He call the plan Housing 2.0, and, as part of the effort, civic organizations like Impacct Brooklyn put together affordable housing events to inform residents on how to navigate the New York City Housing lottery. It is one of many monthly meetings the non-profit has been organizing to help people increase their chances of getting homes they can afford.

The city is making an aggressive effort to provide 300,000 affordable housing units for families by 2026 in a new, accelerated development plan announced by Mayor Bill de Blasio shortly after his re-election this month. He call the plan Housing 2.0, and, as part of the effort, civic organizations like Impacct Brooklyn put together affordable housing events to inform residents on how to navigate the New York City Housing lottery. It is one of many monthly meetings the non-profit has been organizing to help people increase their chances of getting homes they can afford.

The odds are not good, however. For every available rent subsidized apartment in the city, there are an estimated 900 applicants a year, according to 2015 research by the NYU Furman Center.

The information session goes on for two hours, from 3 to 5 p.m., as Campbell explains the complicated system of affordable housing in New York City. She talks the audience through how the application process works, how applicants are disqualified, how many applications people can put in, and how income and credit scores affect the application.

Photo by Efua Owusu for The Brooklyn Ink

Mkele is one out of many hundreds of New Yorkers looking for affordable housing. It has only been two weeks since she put an application in online, but after today’s information session, the single mother does not believe she will be able to qualify for any of the affordable housing units based on the income requirements for a two-family household. “I think I have a high income, but I feel my salary doesn’t get me to the end of the month with all my bills and aftercare. I can’t afford a decent apartment; I have to share with a whole lot of strangers.” So in the meantime, Mkele and her son live in one room in a three-bedroom apartment. She pays $900 a month for the single room and would like to pay the same for a one-bedroom apartment.

Mkele has come a long way and not just from South Africa. When she arrived in New York City she was living in an AirBnB. She then moved into an apartment where she was paying $1,400 a month on rent, but she was living off her credit card. “I didn’t know any better,” she says. After living in New York for eight months now, Mkele is already frustrated with the price and quality of housing in the city. “This is not the New York I imagined.” She is getting desperate, and she jokes about finding a husband to become a double-income family.

Also desperately seeking affordable housing is Hymie Rivera, a 62-year-old musician. He has traveled all the way from Mosholu Parkway and Gun Hill Road in the Bronx to get a breakdown of the annual household income bracket. He has also applied to NYC Housing Connect for affordable housing and has not heard anything about any available apartments, so he lives with his friend, a Grammy Award-winning pianist, Albert “Chip” Crawford, while he looks for a place of his own. “I’ve been messing with Housing Connect,” he says, referring to the city website for affordable housing applications, “for three years. I don’t make enough money.” He is holding five Impacct Brooklyn-branded bags with all the information about affordable housing. “I give them out, to all my musician friends or young ladies who have kids. I give them out to people I know.”

Rivera gets a pension but according to him it is not enough to rent an apartment on a monthly income of $1,600. Before moving in with his friend Crawford, he was renting a bedroom in an apartment week to week for $150.

“They make it real difficult,” he says. “There are so many people out there homeless, especially those in the arts.” He feels housing policies cut off a huge chunk of the population from access to homes. Rivera wants information on how to beat the system, but is not optimistic about his chances of getting an affordable home based on his income.

The Executive Director of Impacct Brooklyn, Bernell Grier says an underdeveloped workforce plays a huge role in the city’s housing crisis. “It used to be that we applied for grants for housing and mortgage programs, but now we apply for grants for workforce programs because the root of the issue is that people don’t have income to afford housing.”

Shayla Austin, the lead Community Organizer for Impacct, has concluded through research, her interactions, and work with renters in Brooklyn that more people are room-mating, living with friends, or moving back home with family to save on rent. “Un-stabilized rentals are the price of a mortgage. People in Brooklyn are paying an average of $2,000 for a one-bedroom apartment. Some 60 to 70% of people’s incomes are going towards rent.” According to the U.S. Department of Housing, families who spend more than 30% of their income on housing are paying too much and may be unable to afford other living expenses like food, clothing, transportation, and medical care.

The affordable housing lottery system is not elusive for everybody though.

Adam James lives in a rent-subsidized apartment. He put in an application to Housing Connect last December and it took him nine months to get approval for an apartment. “I went in blind, brought documents I thought I needed and it didn’t go well.” He says it was not until he reached out to Impacct and received one-on-one coaching on his paperwork before he had the confidence to go into an interview, after being shortlisted for an apartment. He now works with Impacct Brooklyn as an administrative assistant.

For Mkele, even though she might not meet the annual household income requirements on paper, she is relying on faith to get a decent rental. “I don’t think I qualify for any,” she says, “but you know, sometimes you just try your luck and pray.”

Leave a Reply